Managing user permissions in Xero might seem like a small task, but for Malaysian SMEs, it can make the difference between smooth operations and costly mistakes. Many business owners unknowingly give staff full access to sensitive financial data without considering the risks—data breaches, fraud, or accidental errors that could derail compliance. If your goal is to keep your books secure, your processes efficient, and your team accountable, understanding Xero access controls is non-negotiable.

In this comprehensive guide, we will explore what these permission levels mean, how to assign them correctly, and why security and effective team management matter for Malaysian businesses. By the end, you’ll know how to configure user roles confidently, avoid security risks, and ensure your organization stays compliant and productive.

Why Xero User Permissions Matter for Malaysian Businesses

Every SME in Malaysia handles sensitive financial data daily—whether it’s invoices, purchase orders, payroll details, or bank reconciliations. When too many users have unrestricted access to these records, your business faces security risks, compliance challenges, and potential financial losses.

Cybersecurity threats, fraud, and internal errors are not rare. A single mistake or malicious act can cost thousands of ringgit. For example, consider a retail business in Kuala Lumpur that gave its sales executive full Xero access for convenience. Later, the same user accidentally changed bank reconciliation settings, creating accounting discrepancies that took hours to fix. This is more common than most business owners realize—and it proves why role-based access control in Xero is essential.

Managing permissions isn’t just an administrative task—it’s a critical risk management strategy that protects your business from both internal and external threats. Here’s why it matters:

- Reduces security risks: Limits unauthorized access to financial statements and sensitive data.

- Supports compliance: Helps maintain segregation of duties, a key requirement in accounting standards.

- Improves efficiency: Ensures team members only see what they need to perform their tasks, avoiding errors and confusion.

- Protects against data breaches: Reduces exposure to malicious code, suspicious links, and criminal activity.

When implemented properly, access management in Xero strengthen your organization’s cybersecurity posture and help you meet compliance requirements—all while improving workflow efficiency.

What Are Xero User Permission Levels?

Xero provides four main user roles, each designed for specific responsibilities. Let’s break them down:

1. Invoice-Only Access

Ideal for sales teams or purchasing staff who only need to handle invoicing.

Permissions include:

- Create Drafts: Enter sales or purchase transactions as drafts only.

- Sales: Create quotations and invoices for customers.

- Purchases: Create purchase orders and bills.

- Approve & Record Payments: Approve transactions and record payments for sales and purchases.

Important: Invoice-only users cannot view reports, edit company settings, or access confidential financial data.

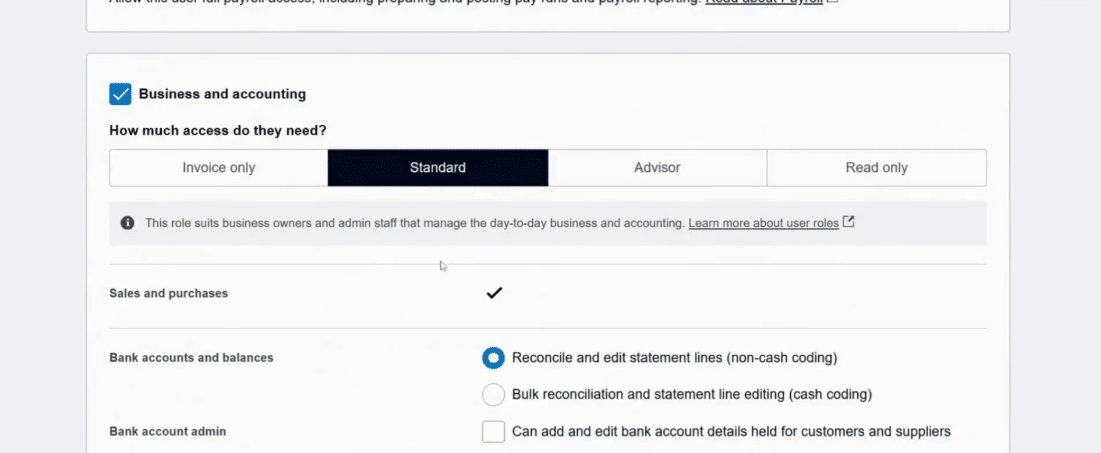

2. Standard Access

This role suits account staff handling day-to-day bookkeeping.

They can:

- Create and approve invoices and bills.

- Perform bank reconciliations.

- Optional: Allow them to view or run reports.

- Optional: Grant user management rights.

3. Advisor Access

The most powerful role—usually reserved for external accountants or Chief Financial Officers (CFOs).

Capabilities include:

- Full access to all transactions and reports.

- Create and edit manual journals.

- Manage fixed assets.

- Add or edit bank account details for suppliers and customers.

- Invite new users, edit roles, or delete users.

4. Read-Only Access

Designed for auditors, consultants, or management staff who need visibility without editing rights.

They can:

- View all transactions.

- Access reports and bank balances.

- Cannot create or approve any transactions.

Quick Comparison Table

The table shows the differences between each Xero access level, making it easier to choose the right role for your team.

| Role | Create Transactions | Access Reports | Manage Users |

|---|---|---|---|

| Invoice Only | Yes (limited) | No | No |

| Standard | Yes | Optional | Optional |

| Advisor | Yes | Yes | Yes |

| Read-Only | No | Yes | No |

How to Add, Manage, and Restrict Access in Xero

Managing users in Xero is straightforward:

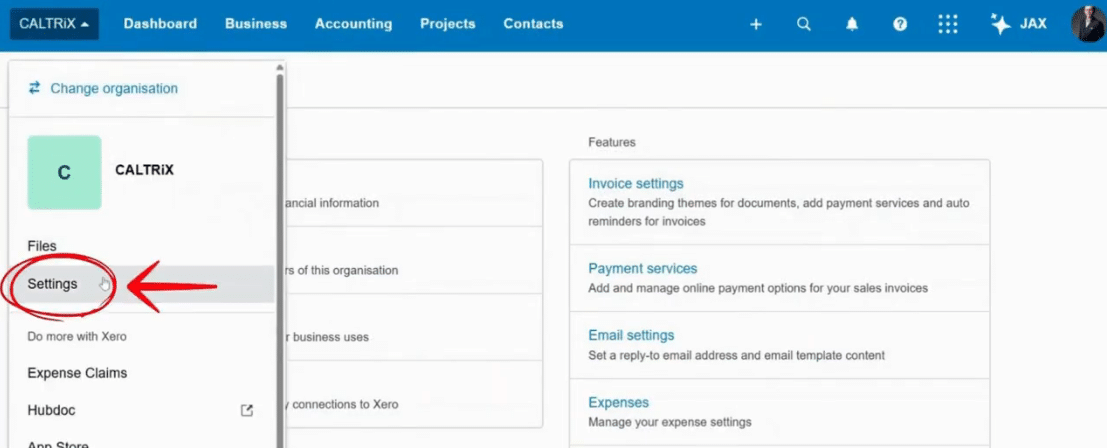

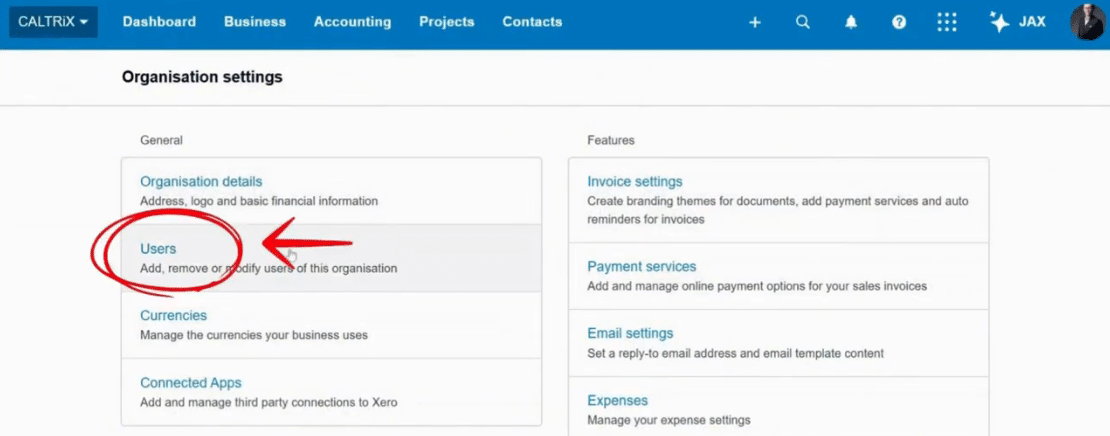

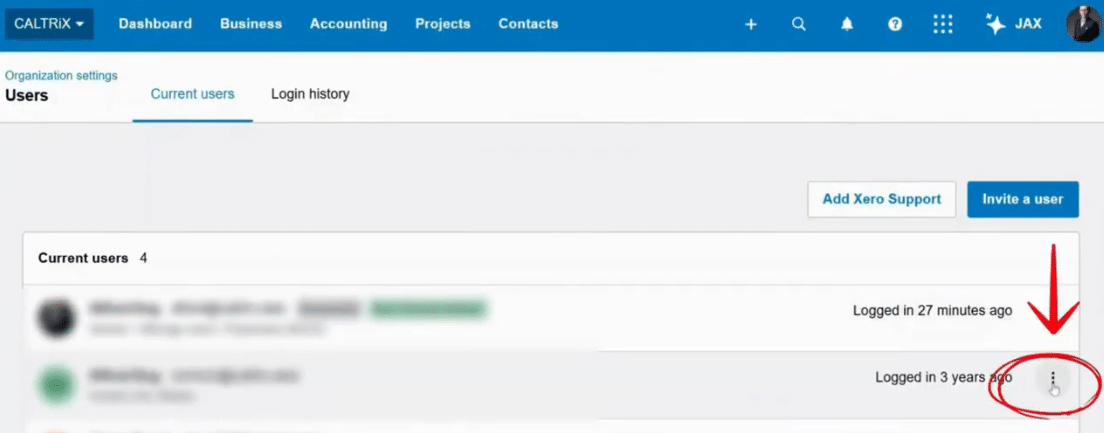

Step 1: Go to Settings

- Click your company name on the top left.

- Select Settings > Users.

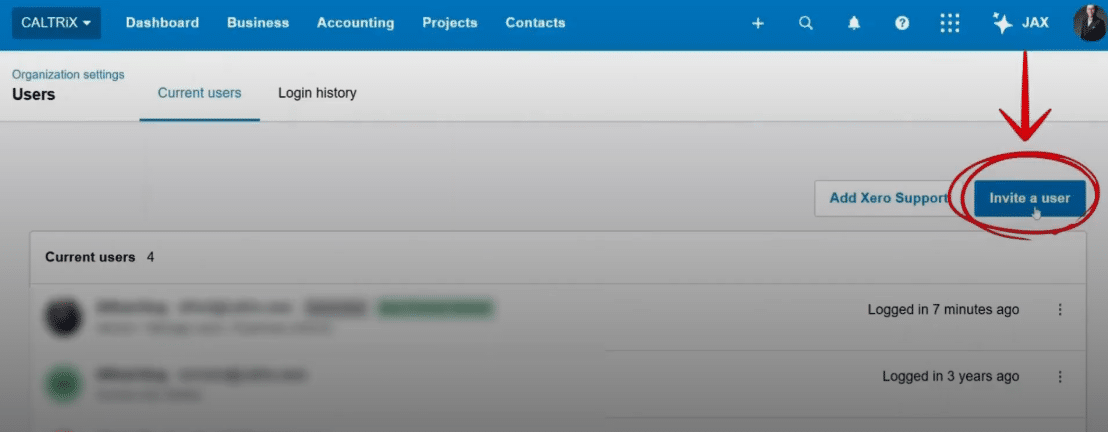

Step 2: Invite a New User

- Click Invite a User.

- Fill in name and email address.

- Assign the appropriate role and permissions.

Step 3: Update Existing Users

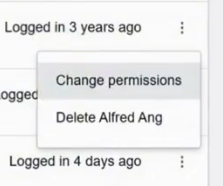

- Locate the user in your list.

- Click the three-dot menu > Change Permissions.

Step 4: Remove Inactive Users

- Select Delete this person’s account.

- Removing inactive users helps restrict access and prevent security breaches.

Prefer a quick walkthrough? Watch the video tutorial here.

Team Management Skills for Xero Permissions

Assigning roles in Xero isn’t just about selecting a checkbox—it’s about leadership and control. Without proper and effective team management skills, even the most well-designed permission system can fail. Why? Because permissions involve people, not just technology.

So, why is team management important in user access control?

- Clear responsibilities: When roles and duties aren’t well-defined, employees may take on tasks outside their scope. This leads to overlaps and confusion. By setting clear responsibilities upfront, you reduce errors and accountability issues.

- Better communication: Many employees see permission restrictions as a lack of trust. Explain why these measures exist—security, compliance, and efficiency. This transparency builds trust instead of resistance.

- Leadership: Your finance and admin teams look to you for direction. Strong leadership ensures everyone follows rules without feeling micromanaged.

To improve your management style, focus on these core skills:

- Active listening: Understand employee concerns about access limitations.

- Open communication: Make it easy for team members to raise questions about their roles.

- Accountability: Hold everyone responsible for following security policies.

These skills will help you manage Xero permissions on a regular basis without creating unnecessary friction.

Security Risks: Why Over-Permissioning is Dangerous

Giving every team member full access to Xero is one of the most common mistakes SMEs make—especially in fast-growing businesses that prioritize speed over control. But this shortcut comes at a high cost. Here’s why:

- Increases chances of data breaches: A compromised account with full access can leak confidential information, such as payroll and tax details.

- Exposes confidential financial statements: Staff who don’t need to view P&L reports could accidentally (or intentionally) share sensitive data.

- Creates opportunities for fraud or criminal activity: Full access allows unauthorized changes to supplier bank details or financial records.

- Compromises compliance: Malaysian tax laws require accurate reporting. Uncontrolled edits to financial statements can lead to errors, audits, or penalties.

To reduce these risks, apply the principle of least privilege:

– Give employees only the access they need to perform their jobs—nothing more.

– Review permissions regularly to remove unnecessary rights.

This simple practice is a cornerstone of risk management and protects your business from both internal and external threats.

Cybersecurity Best Practices for Xero Users

Managing permissions is just one part of a bigger picture—keeping your financial system secure. Here are essential cybersecurity practices every Malaysian SME should follow:

- Enable Multi-Factor Authentication (MFA): MFA adds a critical extra layer of security. Even if a password is compromised, attackers can’t log in without the second authentication factor. Use Xero’s own authenticator or apps like Google Authenticator.

- Educate staff on cybersecurity practices: Human error is one of the biggest cybersecurity threats. Train employees to identify phishing emails, avoid suspicious links, and report unusual activity.

- Audit user roles regularly: At least every quarter, check for inactive accounts or users with unnecessary privileges—especially before tax season or audits.

- Backup email settings: Ensure recovery emails are accurate so you can restore access quickly if an account is compromised or a device is lost.

- Monitor for suspicious activity: Use Xero’s login history and activity logs to spot unusual patterns, such as logins from unknown locations or after working hours.

These steps combine technology and human vigilance to reduce data breaches and cybersecurity threats.

Effective Communication in Managing Access

Restricting permissions can become a sensitive issue if not explained well. Employees might feel singled out or mistrusted. Here’s how to communicate effectively when managing Xero access:

- Be transparent: Explain the reasoning behind permission policies. Frame it as protecting the business and employees, not as a lack of trust.

- Encourage open communication: Create a safe space for team members to ask questions and clarify doubts about their roles.

- Provide training sessions: Use these sessions not only for system navigation but also for personal development—emphasizing accountability, cybersecurity best practices, and compliance.

When everyone understands the common goal—data security, compliance, and efficiency—they are far more likely to cooperate and take ownership.

Pro Tips for Malaysian SMEs

Managing permissions isn’t a one-time task. It’s an ongoing process. Here are five pro tips to keep your Xero setup secure and efficient:

- Start with clear rules: Define access levels during onboarding. Document these policies in your employee handbook or internal SOP.

- Use role-based access control (RBAC): Align roles with actual job functions to minimize unnecessary access.

- Enable MFA for all users: A simple step that can prevent unauthorized logins even if passwords are leaked.

- Audit permissions quarterly: Remove inactive accounts and confirm that current roles match responsibilities.

- Document everything: Maintain an audit trail of permission changes for accountability and compliance. This is especially important for SMEs preparing for external audits or tax submissions.

By implementing these strategies, you’re not just managing user permissions—you’re building a secure, compliant, and efficient accounting environment for your business.

Final Thoughts: Smart Permissions = Safer Business

Configuring Xero user access levels is more than a technical step—it’s a strategic decision for data security, compliance, and efficiency. For Malaysian SMEs or even smaller organizations, proper access control means fewer risks, smoother audits, and better team accountability. Combine permissions with cybersecurity best practices and effective team management, and you’ll have a strong foundation for financial control.

Need expert help with your Xero setup? Caltrix is Malaysia’s award-winning Xero partner, ready to assist with configuration, reviews, and training.

Learn more about Xero Features -> Xero Cloud Accounting Software Feature Malaysia

About Xero

Xero is a global small business platform with 4.4 million subscribers. Xero’s smart tools help small businesses and their advisors to control core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and control their finances more efficiently.