Malaysian SMEs can now use cloud accounting softwares to manage accounts. Xero is actually among the highest ranked online accounting softwares which have a feature set perfect for small business owners. Is Xero suitable enough for my Malaysian business, then? Let us see how Xero differs when it comes to the Malaysian business environment and whether it’s appropriate for your business or not.

What is Cloud-Based Accounting Software?

Cloud accounting software such as Xero gives owners of the accounts access anywhere and everywhere there is an internet connection. It has the greatest impact on Malaysian SMEs because it allows real-time access to accounting information and automated bookkeeping. A cloud accounting system is superior to manual input systems due to the fact that it automates almost all the processes, reduces errors, and saves time.

For example, Xero accounting software is best suited for ease of use and strong features. It is best for Malaysian businesses with local currency support, tax file compliance, and local bank compatibility. The other cloud accounting software stores your finances information securely in the cloud and allows you to view your business performance and financial position in real time.

How Xero Aids Cash Flow Management

Cash flow is success to each business. Entrepreneurs with Xero are in a position to track bank balances, unpaid bills, and bill payments with ease. The bank feeds feature offers automated importing of transactions, in accordance with which the process of reconciling transactions becomes simple, and your finance report provides a clear picture of your standing at any given point of your choice. The real-time visibility offers Malaysian SMEs full awareness, such that they can make informed decisions and support their business day-to-day operations.

Check on the blog -> 5 Ways Xero Improves Cash Flow Management for Malaysian Businesses

Do they have a free trial of Xero?

There is a trial period of 30 days free of charge. You may utilize the site features without incurring even a single penny. This will allow you to get an idea about how Xero fits into your company’s requirements. You can try out basic features such as bank feeds, invoicing, and accounting reports. It gives you first-hand experience of using its ease of use and localized features before you buy it.

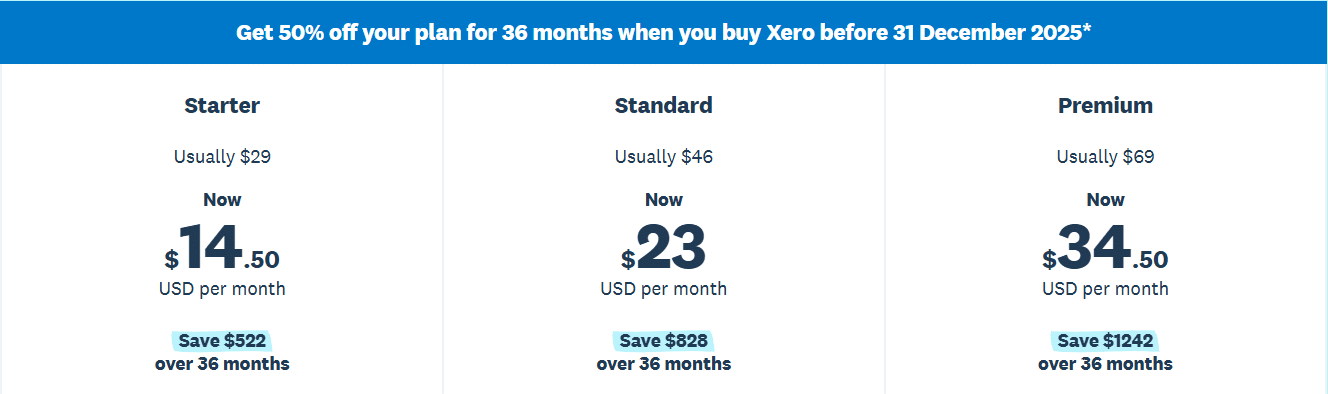

The following are the rates of each of the plans of Xero, starting form RM63 per month. For viewing the actual feature comparison of the plans, pleaes check on screenshot as below.

Key Features of Xero Cloud Accounting Software

Xero’s large repository of apps caters to thousands of business requirements:

Bank Reconciliations:

Effortlessly reconcile your accounting records to your bank transactions and bank account by automatically reading and synchronizing your bank transaction import, ensuring your financial records are accurate and up to date.

Inventory Management & Inventory Tracking:

For manufacturers, retailers, or distributors, the app manages purchase orders and tracks inventory.

Send Invoices & E Invoicing:

Send invoices electronically with e-invoicing for convenient receivables, including managing outstanding invoices.

Pay Bills & Expense Claims:

Pay bills and expense claims easily with the help of Xero Expenses.

Financial Insights & Reports:

Set up detailed balance sheets, profit and loss accounts, and additional financial reports to monitor your financial performance. The general ledger is maintained efficiently, providing full visibility into your financial situation.

Who Should Use Xero? Is Xero suitable for my business Malaysia?

Xero is used by small business operators in businesses that are retail, hospitality, professional services, and manufacturing. It is used most by service businesses requiring first-class invoicing, expense claims, and mobility using the Xero mobile app. It is easy to use so it is ideal for small business operators requiring control of finances without the need for accounting skills.

Refer to the blog -> 7 Powerful Xero’s Mobile App features for On-the-Go Accounting

Industry Suitability for Malaysian SMEs

Xero features are most suitable for the following Malaysian industries:

- Professional services (lawyers, consultants, accountants)

- Hospitality (restaurants, cafés)

- Manufacturing and production

The Malaysian SME needs and compliance covered by platform-specific and tool-specific integrations made it a suitable solution for Malaysian SMEs.

Xero helps simplify bookkeeping and financial administration. It puts all of your finances in one place and makes them simpler to manage. It doesn’t necessarily eliminate the need for a client’s accountant, though.

Do I still need an accountant if I use Xero?

An accountant does something no computer will ever do. They ensure your accounts are in accordance with local law and accurate. They provide you with tax planning recommendations that are worth their weight in gold. It could save you money and penalty fees.

Accountants also help you with complicated compliance issues. They go through your financial data to help with strategic decision-making on planning. Their advice can make or break business growth.

While Xero can get its hands dirty, it is preferable to have an accountant. Xero usage can cut down on them. It can be cheap. It also saves time.

In short, Xero offers an easy way to handle finances. Professional advice, however, is still needed. It makes compliance simpler, tax optimization, and making the right decisions feasible.

Is Xero or QuickBooks Better?

QuickBooks vs Xero, both are the best cloud accounting software with excellent features, but the best will depend on your company’s needs:

- Ease of Use: Both are simple to use, although there are a few who find Xero’s dashboard more intuitive in handling more currencies and industries.

- Features: QuickBooks has more sophisticated payroll features and industry features, thus ideal for those businesses that are payroll-reliant.

- Pricing: They both have comparable pricing models, with Xero generally less expensive for small organizations with straightforward needs.

- Integrations: Both have humongous third-party integrations; Xero has a slight advantage with its vertical marketplace of add-ons in terms of industries such as retail and manufacturing.

- Malaysia Businesses Support: While both accounting software have functionality to support the local currency and taxation needs, Xero’s locally focused variant and support personnel located in Malaysia can be an advantage for small local businesses.

Check on the blog -> Top 5 E-Invoice Cloud Accounting Software in Malaysia

Overall, Xero fills the need of small business individuals who need ease, live access, and localized capabilities, and QuickBooks can be appropriate for those needing more complex payroll needs or industry-focused needs.

Additionally, Caltrix Asia is an Xero-certified qualified implementation partner. Its experts provide customized solutions for easy installation, support documents online, and comprehensive training and after-sales support.

Small business owners can trust Caltrix Asia to facilitate them in extracting the maximum benefits of Xero. They possess industry experience and hence can tailor the system as per the requirement. Master guidance at every step is what you can receive from Caltrix Asia.

We recommend that Caltrix Asia implement Xero software for you. They are experts and will save you time and reduce errors. They can help you make the most out of the use of the software. Anyone can book a free 30-minute consultation call today!

Conclusion

Is Xero suitable for my Malaysian business? Do you require an accounting solution that provides real-time visibility, simple bank reconciliations, inventory tracking, and automated invoicing? Then, yes, Xero enables small business people to do more business. With it being cloud-based, it also means having your financial data in one location, either in the office, at home, or even on the go using the mobile app of Xero.