Running a business in Malaysia and using Xero? Then setting up the right Xero Chart of Accounts (COA) is more than just a one-time administrative task — it’s a foundation that impacts your tax reporting, audit readiness, and long-term financial visibility. A well-organized Chart of Accounts enables efficient tracking of your business transactions, supports compliance with Malaysian SST regulations, and enhances the clarity of your financial reports.

In this guide, we’ll cover everything Malaysian SMEs need to know to optimize their Chart of Accounts, including key setup steps, common mistakes to avoid, and best practices to follow.

Why the Right Account Structure Matters

Your Chart of Accounts determines how your financial transactions are recorded, grouped, and reported. While Xero provides a default structure, Malaysian businesses face significant challenges if they rely solely on that.

Key Reasons to Customize Your Chart of Accounts:

- Compliance Alignment: Ensure your accounts reflect the correct SST tax codes and requirements under Malaysian tax law.

- Business Processes: Align accounts with how your business operates, including cost centers and departments.

- Reporting Clarity: Create customized Profit & Loss and Balance Sheet reports for stakeholders.

- Risk Management: Avoid confusion or errors in transaction categorization which could lead to tax penalties.

- Scalability: Future-proof your accounting setup to support new programs, new technologies, and business expansion, fostering a more successful business.

Getting Started: Xero Chart of Accounts

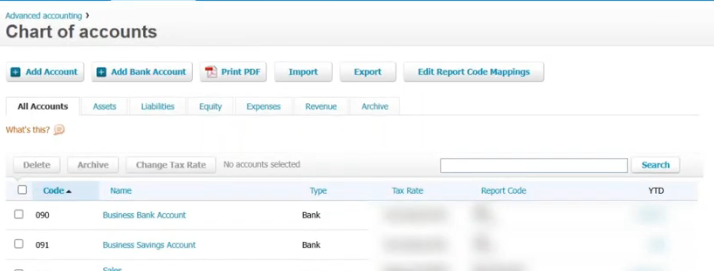

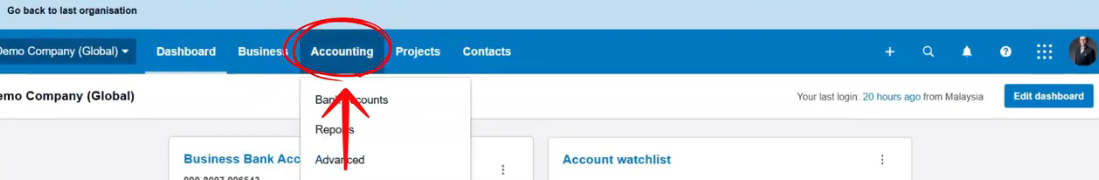

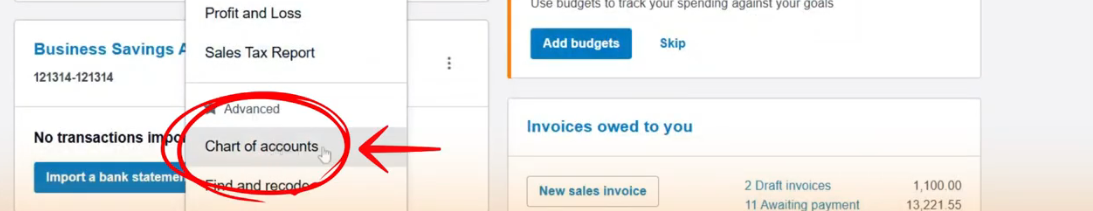

To access your Chart of Accounts in Xero:

- Go to Accounting > Chart of Accounts

- You’ll see the default accounts grouped under Assets, Liabilities, Equity, Expenses, and Revenue.

- From here, you can add, edit, archive, or delete accounts to better reflect your business model.

Let’s go through these step-by-step guidelines.

Adding a New Account

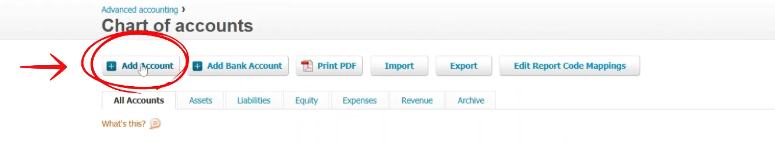

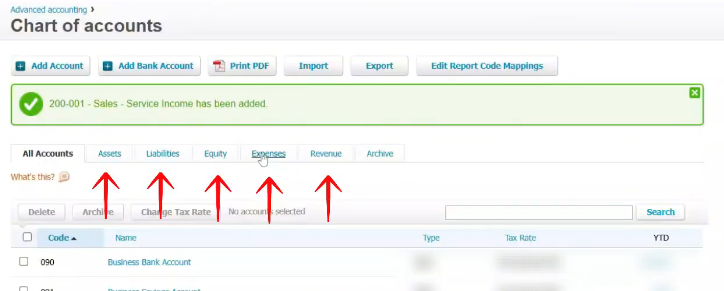

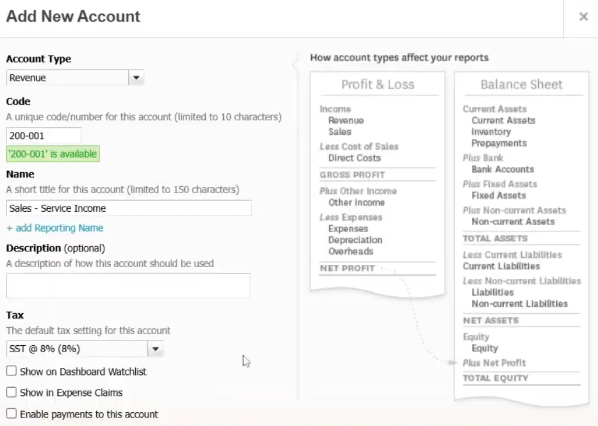

To create a new account:

- Click Add Account

- Choose an appropriate Account Type (e.g., Revenue, Expense, Asset)

- Assign an Account Code (e.g., 200-001 for Revenue)

- Name your account (e.g., Sales – Service Income)

- Select the correct Tax Rate (e.g., 6% SST)

- Click Save

Best Practice: Use a consistent numbering format to distinguish account types (e.g., 100-xxx for assets, 200-xxx for revenue, 400-xxx for expenses). This helps with organization and scalability.

Editing an Account

To modify an existing account:

- Use the search bar or filter by account type to locate the account

- Click into the account to change:

- Account Name

- Account Code

- Description

- Tax Rate

- Click Save to apply changes

Note: System-generated accounts (with a lock icon) cannot be deleted and should only be modified under expert guidance.

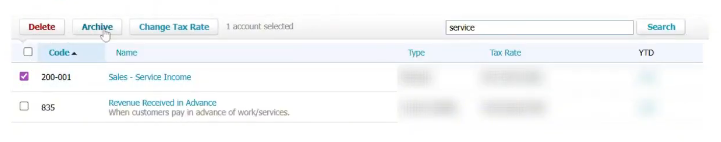

Deleting or Archiving an Account

You may want to remove unused accounts to keep your Chart of Accounts clean. Here’s how:

- Tick the box next to the account

- Click on Archive or Delete

What Happens Next:

- Delete: Only possible if there are no transactions tied to the account

- Archive: If the account has past transactions, Xero will archive it automatically

- Archived Tab: Archived accounts can be viewed and reactivated if needed

Watch our detailed step-by-step guide here to follow along easily.

Top 3 Mistakes That Xero Users Made in Chart of Accounts

When setting up your Chart of Accounts, many SMEs face challenges that can impact reporting accuracy, tax compliance, and overall business processes. Here are the top three mistakes and how to avoid them:

1. Inconsistency of Chart of Accounts Code and Account Name

One of the most common issues is inconsistent account structure, including spelling errors or mismatched account numbers. This can create confusion when generating reports, auditing transactions, or analyzing financial data. A consistent structure is crucial to maintain data integrity, enable continuous learning within your team, and ensure that your finance tools can properly manage and report on all accounts.

Best Practice Tip: Standardize account codes and names across your organization, follow guidelines for numbering, and regularly review the COA to identify and correct inconsistencies.

2. Failing to Set Up the Correct Tax Rate

Incorrect or missing tax rates in your accounts can lead to significant issues during SST filing, compliance checks, and audits. Many users overlook this step, which results in additional time spent verifying transactions and reconciling SST amounts.

Watch our step-by-step guide to update SST tax rates in Xero: How to Update SST Tax Rates in Xero

Assign the correct tax rate for each account to reduce risk, maintain compliance alignment, and enable more accurate reporting. This ensures that business processes flow smoothly and allows your finance team to focus on strategic activities rather than manual corrections.

3. Misclassifying Expenses as COGS or Vice Versa

Many Malaysian SMEs incorrectly categorize payment gateway fees, credit card charges, and platform-specific costs (like iPay88, PayPal, or Stripe) as Expenses instead of Cost of Goods Sold (COGS). This misclassification affects profitability reports, data accuracy, and can impact financial evaluation for leadership decisions or investor reporting.

Correct Classification Practice:

- Identify all costs that are directly linked to the completion of a sale.

- Assign these costs to COGS to accurately reflect your gross profit.

- Use your COA to create accounts that clearly distinguish between operational expenses and cost of sales.

By addressing these mistakes, Malaysian SMEs can optimize their Chart of Accounts, improve reporting accuracy, and achieve successful business outcomes.

Best Practice: How to Build a Scalable Chart of Accounts

A well-structured Chart of Accounts is not just about compliance — it supports growth, operational efficiency, and scalable business operations. Here’s an enhanced guide for Malaysian SMEs to score higher in SEO and maintain a successful account structure.

1. Use Industry Templates as a Starting Point

Leverage industry-specific templates tailored for sectors like retail, trading, or healthcare. These prebuilt templates provide a solid account structure, ensuring alignment with local compliance guidelines while allowing customization to fit your unique business processes.

2. Don’t Overcomplicate

Avoid creating an excessive number of accounts. Keep your COA simple and intuitive so that multiple team members can engage effectively. A clear structure helps identify key accounts, manage data efficiently, and reduce risk in reporting.

3. Use Consistent Account Numbering

Group accounts by category using a unified format, making it easier to manage and report financial data:

- 100-xxx: Current Assets

- 200-xxx: Revenue

- 400-xxx: Direct Expenses (COGS)

- 500-xxx: Operating Expenses

Consistency ensures better data validation, supports continuous learning, and facilitates integration with financial tools.

4. Import a Full Chart of Accounts for New Setups

If starting from scratch, importing a Malaysia-compliant Xero COA template saves time, especially when switching from systems like AutoCount, SQL, or Excel:

- Download our Malaysian-friendly template HERE

- Click Import in Xero and upload the CSV file

Note: Only use this if you are starting fresh — do not overwrite an active COA. You can still refer to the template to identify missing accounts and customize your structure.

5. Review Chart Quarterly

Regularly evaluate your accounts, especially before SST filing or audits. This helps verify tax rates, maintain a compliant account structure, and ensure financial data accuracy.

6. Consult Your Accountant Before Making Changes

Always engage your accountant before modifying account types or system-generated accounts. This reduces risk, ensures compliance alignment, and supports correct financial reporting.

7. Understand System Account Codes & Names

Xero system accounts with a LOCK ICON should not be modified without proper understanding:

- Sales Tax Account: Linked to SST transactions

- Unrealized Currency Gain: Calculates unrealized FX gains/losses on unpaid invoices/bills

- Realized Currency Gain: Calculates realized FX gains/losses on paid invoices/bills based on exchange rate differences

8. Customize Profit & Loss and Balance Sheet Reports

Xero does not allow grouping accounts in the COA. However, customizing your Profit & Loss Account and Balance Sheet enables better reporting and analysis:

- Organize accounts logically to identify trends

- Allocate resources efficiently

- Support leadership and strategic decision-making

- Maintain compliance with SST and audit requirements

9. Standardize Across Multiple Xero Accounts

For businesses managing multiple entities, standardize the COA to support consolidated reporting software. This ensures seamless integration and unified Profit & Loss and Balance Sheet reporting.

Check out: Top 5 Cloud Consolidation Tools for Xero Malaysia

10. Continuous Learning and Improvement

Your COA should evolve with your business. Regularly modify and update accounts to align with new programs, emerging technologies, and business expansion. Adopt continuous learning by:

- Reviewing accounts before tax filings

- Attending Xero training sessions

- Staying updated on accounting standards and software updates

- Collaborating with accountants or Xero implementation partners

11. Security & User Permissions

Ensure only authorized personnel can modify the COA, approve transactions, or adjust tax settings. Set proper user access levels in Xero under Settings > Users to maintain data integrity and security.

12. Real-World Example: Malaysian Retail SME

A retail SME with physical and e-commerce stores can benefit from splitting revenue accounts:

- 200-001: Retail Sales (Physical Store)

- 200-002: Online Sales (Shopee, Lazada)

- 200-003: International Sales

This granular account structure allows better data analysis, identifies key revenue drivers, and prepares the business for future expansion.

“Your Chart of Accounts is not just a setup task — it’s a living structure that supports your business growth.”

By following these practices, Malaysian SMEs can maintain an optimized, scalable, and compliant Chart of Accounts, improving reporting accuracy, operational efficiency, and supporting successful business operations.

Final Thoughts: Build It Right from the Start

Setting up your Xero Chart of Accounts correctly gives your business a strategic edge. You’ll enjoy:

- Accurate reporting

- Easier audits

- Better tax compliance

- Improved internal processes

Need Expert Help Setting Up or Migrating to Xero?

At CALTRiX, we provide comprehensive services to ensure a smooth transition and optimized setup for your business:

- Xero Setup & Configuration: Tailored implementation to align with your business needs.

- Chart of Accounts Restructuring: Build a scalable, compliant, and efficient account structure.

- Migration from SQL, AutoCount, and Excel: Seamless transfer of your historical data with zero disruption.

🔹 Why Choose CALTRiX?

- Specialized in Malaysian SME accounting needs

- Ensure compliance with SST and local regulations

- Streamlined onboarding with expert guidance

- Maximize the benefits of Xero for accurate reporting and operational efficiency

📧 Get Started Today: Contact us at connect@caltrix.asia or schedule a consultation call with us and transform your accounting setup into a successful, scalable system.

About Xero

Xero is a global small business platform with 4.4 million subscribers. Xero’s smart tools help small businesses and their advisors to control core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and control their finances more efficiently.