Budgeting isn’t just a spreadsheet exercise — it’s your roadmap to keeping cash flowing, reducing surprises, and hitting long term financial goals. For many Malaysian SMEs that once tracked everything in Excel, moving to Xero’s built-in planning tools removes guesswork and speeds up decision making. This guide walks you through budget tracking features, step-by-step budget setup, variance analysis, updating budgets, and practical tips for saving money, lowering liabilities, and handling contingencies.

How Xero Budget Tracking Features Help Malaysian SMEs Plan and Monitor Finances

Xero’s Budget Manager and Budget Variance report let you create monthly (or annual) budgets, compare actual income and expenses to those numbers, and run quick performance monitoring across departments using tracking categories. You can build a master budget (e.g., “2026 Master Budget”), use prior year actuals as a starting point, and then apply methods such as a fixed amount, an amount adjustment, or a percentage adjustment to fill out future months — handy when you expect steady growth or seasonal ramps. Learn how to create a budget in Xero using the Budget Manager.

Key points you’ll use every month:

- Create budgets aligned to your P&L categories so income, expenses, taxes, and contributions are documented and comparable.

- Use tracking categories (outlet, department, project) to divide responsibility and find out where spending or savings are occurring.

- Export or import budgets via CSV/Excel when you want to edit offline or run advanced forecasting in a spreadsheet. Xero supports importing budgets and re-importing updates.

Why this matters: Instead of searching through bank statements or a stack of bills to find out whether a marketing campaign made you more money than it cost, the Budget Variance report shows the difference (and percentage) between actual and budget — quickly flagging areas to revise.

With that level of clarity, it becomes much easier to spot problem areas in your finances — and one of the most common challenges for SMEs is managing credit card bills.

Managing Credit Card Debt Through Better Budget Tracking

Business credit card spending is often a hidden cause of cash crunches. Put card spend into your budget categories (e.g., marketing, travel, utilities, mobile/data) and track monthly bills so you always know whether credit card usage is in line with plan.

Practical steps:

- Create a “Credit Card” liability account and map card spending to expense categories in your Chart of Accounts.

- Budget for card repayments (plan to pay the full statement where possible) and include interest and fees as an expense line so variance analysis shows the real cost.

- Use the Budget Variance report to flag card overspend (red = overspending). If you spot repeated overspend on a category paid by card, decide on stricter card usage rules or move to pre-approved purchase limits.

Tip: Treat credit card repayment like a fixed cost (similar to rent or mortgage) until it is under control. That makes it easier to figure out how much cash is available for growth or investing.

Once credit card liability is under control, the next opportunity is to put those freed-up funds to better use — starting with saving money in your business.

How to Save Money in Your Business Using Xero’s Budgeting Tools

“Save money” is more than a headline — it’s a process you can measure with Xero.

Ways Xero helps you save:

- Identify high-spend categories (utilities, mobile, entertainment/marketing) via tracking and reduce wasteful subscriptions or duplicate services.

- Reallocate savings toward business growth so you can make more money (e.g., invest a portion into a targeted ad campaign with trackable ROI).

- Use variance analysis monthly to measure the real difference between planned spending and actuals; small percentage improvements compound over time.

Examples SMEs can try:

- Divide recurring subscriptions into fixed vs variable and schedule quarterly reviews to cancel or renegotiate.

- Document a “three to six months” contingency plan for cash — having a buffer helps you avoid emergency credit lines or costly credit card bill.

- If you find a consistent positive variance (green), determine whether to save the extra cash, reinvest, or pay down debt.

Small changes — swapping to a cheaper mobile plan, negotiating utilities, or deferring non-urgent purchases — can add up quickly. Use Xero’s exported budget to write scenarios and calculate percentage savings to help you decide.

And one of the smartest ways to use those savings is to reduce business debt and free up even more future cash flow.

Reducing Debt by Allocating Cash Flow Wisely in Xero

Reducing debt requires discipline and a documented plan that’s visible to everyone responsible. Xero helps by making debt costs visible in P&L and budgets.

A simple method:

- Calculate total monthly free cash (income minus necessities and fixed costs like rent, utilities, payroll).

- Determine a repayment percentage of that cash to allocate to debt (e.g., 10–20%).

- Write the repayment plan into your budget as a recurring contribution so the Budget Variance report tracks your progress.

Use Tracking Categories to assign debt responsibility (e.g., Outlet A covers its own equipment lease). If you’re handling multiple debts (credit card, supplier balances, bank loan), divide repayments into priority buckets: high interest first, then medium, then low. As you lower liabilities, revise budgets to reflect freed-up cash for savings or investing.

Note: don’t forget the tax angle — plan for taxes and statutory contributions when deciding how much cash is safely available to lower liabilities. LHDN filing dates and obligations can affect your timing and cash requirements.

Once debt is under control, the next step is building resilience — making sure your budget can handle unforeseen circumstances without derailing your progress.

Preparing for Unexpected Events With an Emergency Budget in Xero

A robust budget includes space for contingencies. Unforeseen circumstances — supplier delays, sudden repairs to a company car, or spikes in gas and utilities — should be covered by a dedicated emergency line in your budget.

How to build resilience:

- Target an emergency buffer of quarter to half a year of essential operating expenses (payroll, rent, utilities, minimal stock). This is a widely recommended range for small businesses to survive temporary shocks.

- Include an insurance line in your budget and verify coverage for major business risks.

- Scenario plan: use exported budgets to create “stress test” versions (e.g., 20% drop in sales for two months) and calculate the cash shortfall and necessary cost reductions.

Practical Xero workflow:

- Create a separate tracking category for contingency spending so you can report on use and replenish the buffer as part of quarterly forecasts.

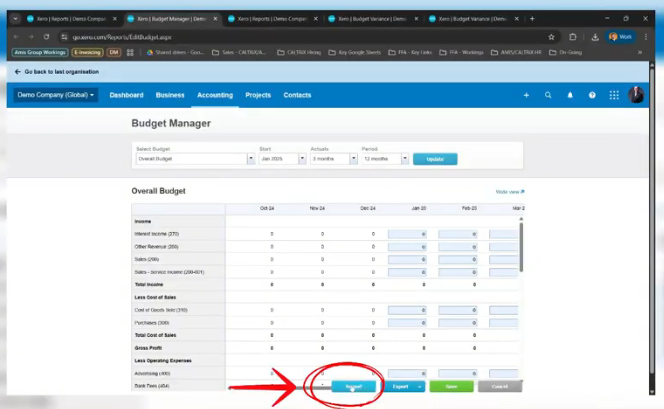

- Export budgets to Excel, run a scenario, and re-import as an updated budget if you choose to make official adjustments. Xero supports export and import workflows for budgets.

Once you’ve accounted for emergencies, you’re ready to put all of this into action by setting up your first budget in Xero.

How to Set Up Your First Budget (Step-by-Step)

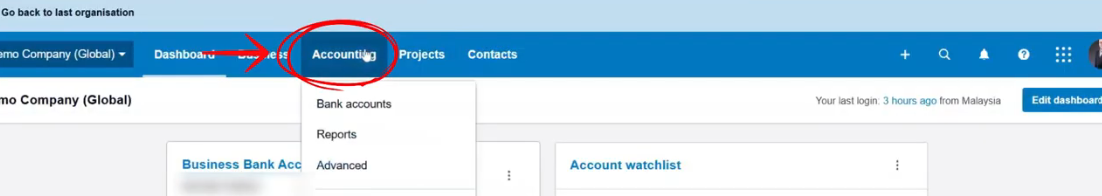

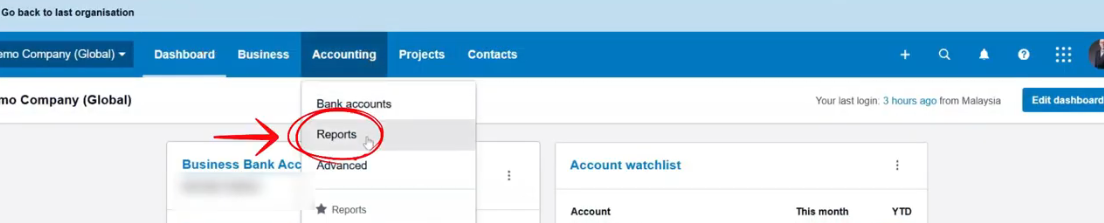

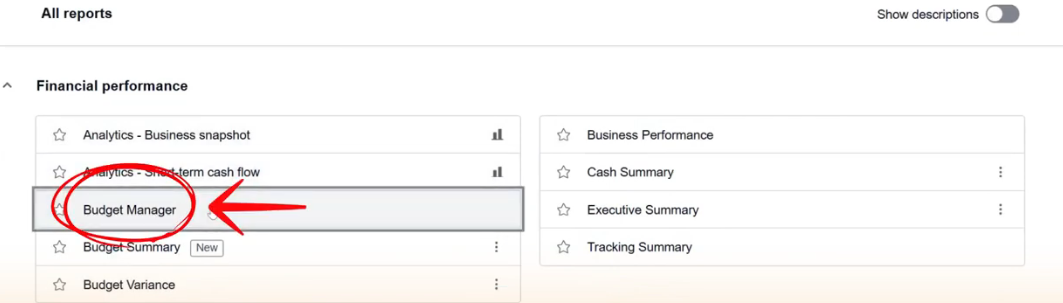

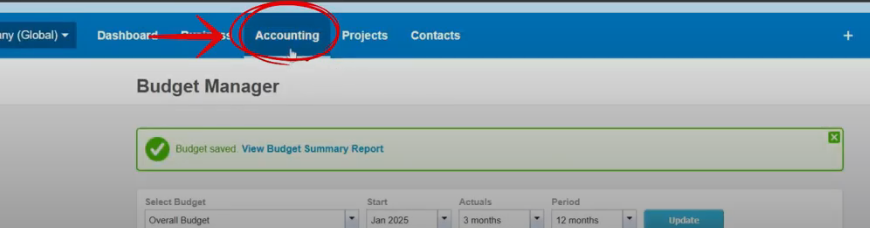

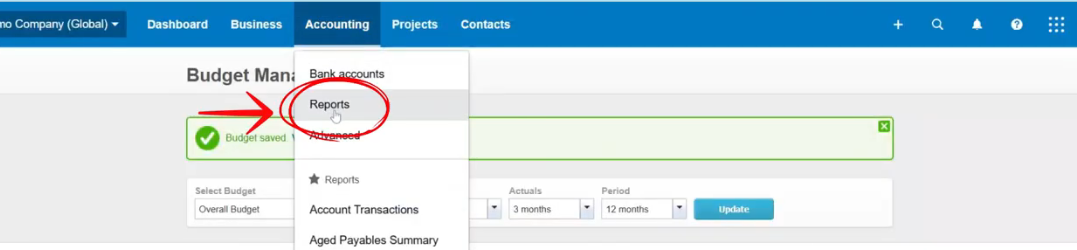

- Go to Accounting > Reports > Budget Manager in Xero.

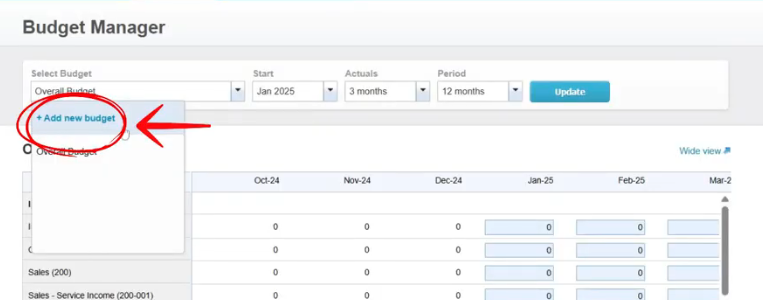

- Choose Add new budget and give it a clear name (e.g., “2026 Master Budget”).

- Select a tracking category if you want budgets by outlet, department or project. This makes performance monitoring practical for multi-site SMEs.

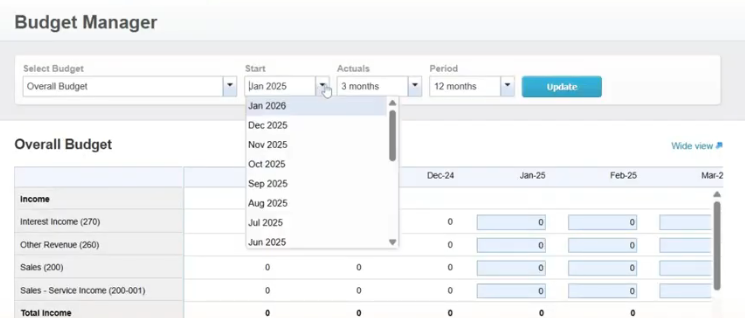

- Set the start month to the first month of your financial year and pick the period (12 months is common).

- Select whether to use actual numbers (none, 3, 6, 12 months) as a base. Using prior year actuals is a good method to determine realistic starting points.

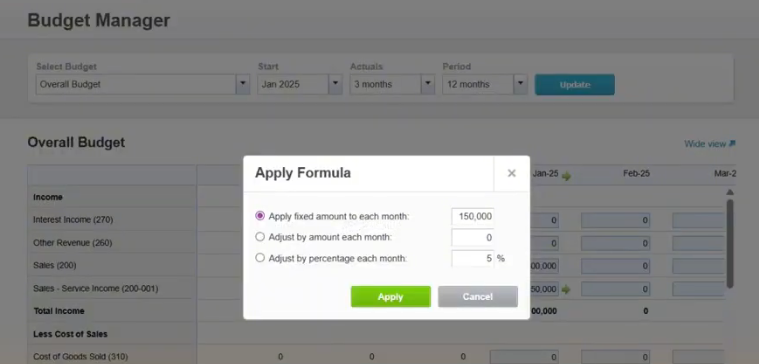

- Enter the first month’s numbers manually. For subsequent months, use the green arrow to: apply a fixed amount, adjust by a value, or adjust by a percentage (e.g., 10% monthly growth). Click Apply and Save when done.

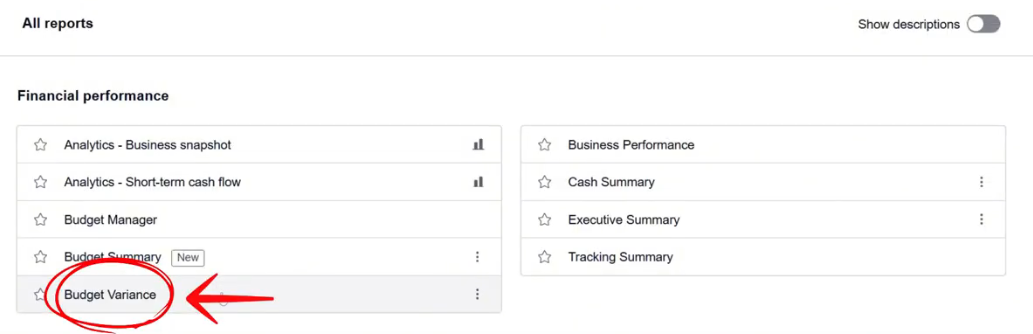

Running Variance Analysis in Xero

Once you’ve entered your actual income and expenses into Xero, the next step is to measure how well you’re sticking to your plan. The Budget Variance Report shows the difference — in both numbers and percentages — between what you budgeted and what actually happened. This quick snapshot helps you spot overspending, uncover savings, and make informed adjustments before small issues become big problems.

How to do it:

- Go to Reports > Budget Variance.

- Choose the budget (e.g., “Overall Budget”) and timeframe (e.g., January 2026 – March 2026).

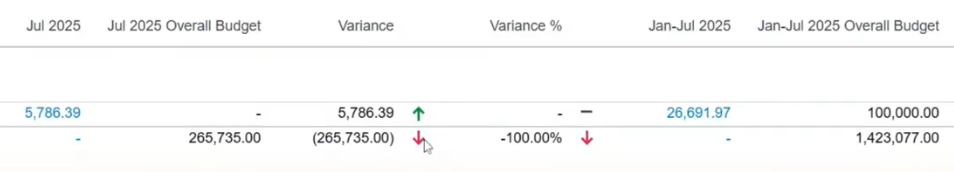

- Read the variance column (actual minus budget in value) and the variance % column. Green indicates better than budget; red signals overspend or underperformance.

Interpretation guidance:

- Don’t treat every red as a failure — if marketing overspent but drove higher revenue, the variance needs context.

- Look at month vs year-to-date to identify trends (one-off items vs ongoing issues).

- Use variance reporting as the basis for operational actions: pause discretionary spending, renegotiate supplier terms, or shift marketing to higher ROI channels.

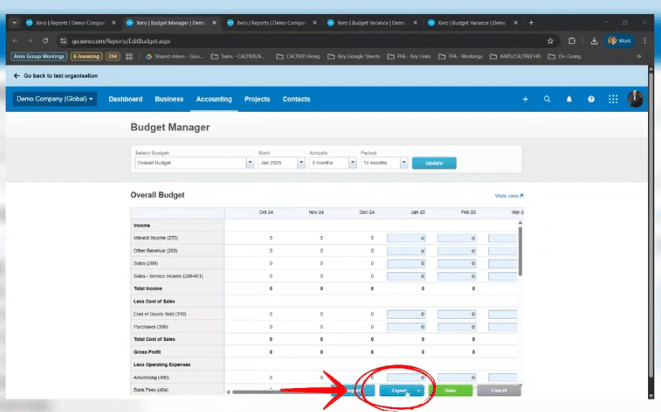

Updating Your Budget for Better Performance Monitoring

If your numbers change during the year, you don’t need to start from scratch. In Xero, you can easily refresh your existing budget by exporting it to Excel, making updates, and then re-importing it as a new version via CSV.

How to do it:

- Click Export Budget to Excel in Xero.

- Update your estimates, adjust figures, or add new projections.

- Re-import the file into Xero as your updated budget.

📌 Why This Matters:

Many Malaysian SMEs struggle with rigid, one-off budgets that quickly become outdated. Xero’s flexibility means you can adapt your budget to match real-world changes — whether that’s shifting priorities, unexpected expenses, or better-than-expected income.

Common Budgeting Mistakes Malaysian SMEs Should Avoid

- Misaligned Chart of Accounts – If budget categories don’t match your P&L, variance reports become unreliable. Always align account names and structure before creating your budget.

- No Clear Ownership – Without someone tracking actual vs budget monthly, overspending can slip through. Assign a responsible person or department to review reports.

- Budgeting Once a Year and Forgetting It – Markets change, so a static annual budget quickly becomes outdated. Review and adjust monthly or quarterly to stay on track.

Best Budgeting Practices for Malaysian SMEs Using Xero

To get the most out of budget tracking features, Malaysian SMEs should follow a structured approach:

- Build your budget before the financial year begins so you have a clear plan to follow from day one.

- Align your budget with your Profit & Loss categories to make income, expenses, and taxes easier to track.

- Break down your budget by department or outlet using Xero’s Tracking Categories (e.g., Outlet A, Outlet B) to see which areas are driving profits or overspending.

- Review your budget every month with the Budget Variance report to compare actual performance against your plan.

- Update your forecast quarterly if market conditions, expenses, or revenue projections change.

By following these Xero budget tracking best practices, Malaysian SMEs can improve cash flow visibility, avoid surprises, and make better financial decisions throughout the year.

Final Thoughts

Budgeting isn’t just about cutting costs — it’s about gaining control and clarity over your business financials. With the budget tracking features in Xero, Malaysian SMEs can spot overspending early, reduce liabilities, free up cash for growth, and react quickly to changing circumstances. Start with a 12-month master budget, review your performance monthly with the Budget Variance report, and make quarterly adjustments to stay on track.

If you need help building your first Xero budget or migrating from Excel, CALTRiX can work with you to create a practical financial plan and set up Xero so your team can focus on growth — not spreadsheets. Email us at connect@caltrix.asia or schedule a call here to get started.

About Xero

Xero is a global small business platform with 4.4 million subscribers. Xero’s smart tools help small businesses and their advisors to control core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and control their finances more efficiently.