Are you tired of manually creating the same invoices, entering bills, and posting salary journals every month? If that sounds familiar, you’re likely not leveraging recurring transactions setup — one of the most underrated automation tools in Xero. Many Malaysian SMEs often underestimate how much time and effort can be saved by automating these repetitive tasks. In this guide, tailored for Malaysian businesses, we’ll show you step-by-step how to automate your monthly tasks with repeating invoices, bills, and journals, ultimately saving you hours of manual work, reducing human errors, and improving overall financial accuracy.

Automation isn’t just about convenience; it’s about improving the quality of your business operations, freeing your team to focus on growth, strategy, and client engagement rather than repetitive administrative tasks.

Why Recurring Transactions Matter for Malaysian SMEs

Using the recurring transactions setup in Xero helps you:

- Reduce manual errors: Mistakes in amounts, dates, or descriptions are common when posting manually. Automation ensures consistency and accuracy.

- Save time: Employees can spend less time on administrative tasks and more on strategic work that drives revenue.

- Improve monthly closing speed: By automating invoices, bills, and journals, the finance team can close books faster and with fewer discrepancies.

- Enhance record-keeping: Every automated transaction is logged with details, providing a clear audit trail for compliance and internal reporting.

For example, if you’re billing a client RM3,000 every month for consultancy, paying RM2,800 for office rent, and posting monthly salary journals, automating these recurring transactions can prevent delays, reduce stress, and minimize the chance of oversight. This approach also ensures that your financial reporting is timely, helping your business make more informed decisions.

Whether you’re a small start-up or a growing SME, automating repetitive tasks through recurring transaction setup is a crucial step in improving financial efficiency.

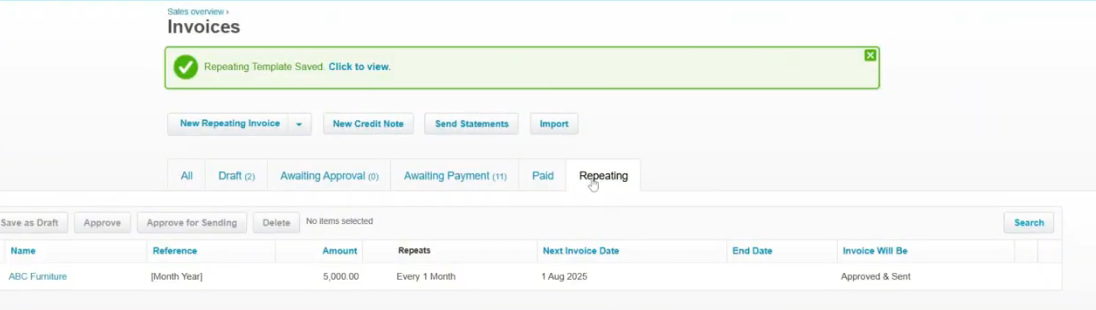

Repeating Invoice Setup

The Repeating Invoice feature is ideal for retainer fees, subscription-based services, or any fixed monthly billing. It’s especially helpful for businesses providing services on an ongoing basis, such as marketing agencies, IT services, or consultancy firms.

Example: Suppose you secured a client for digital marketing services at RM5,000 per month. Manually creating invoices every month is time-consuming and increases the risk of human error. Using Xero’s repeating invoice feature, you can set it up once and let the system handle the rest automatically.

Steps to Set Up:

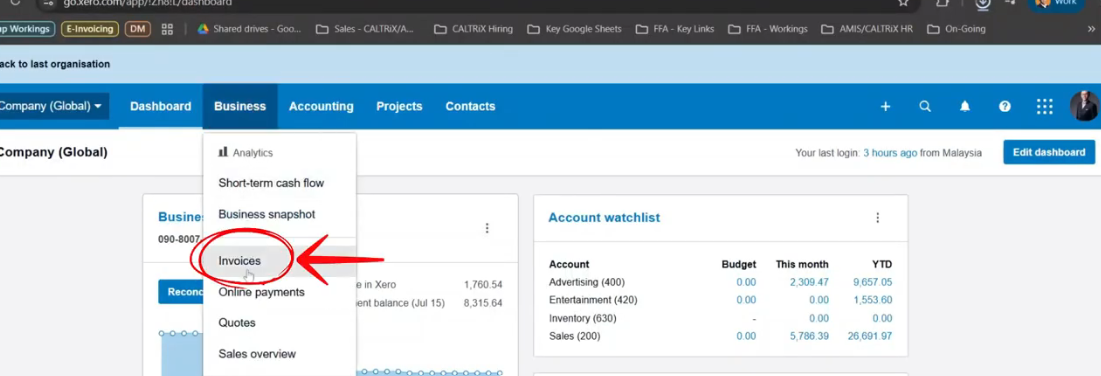

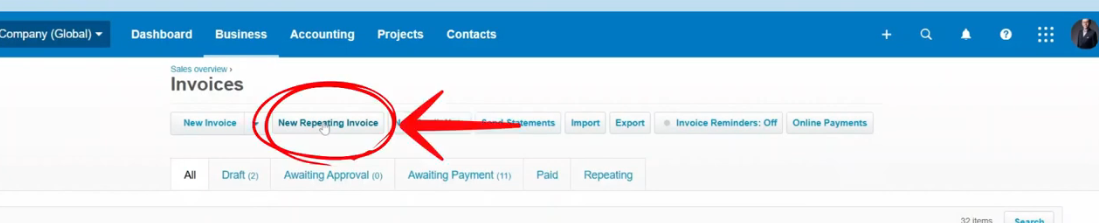

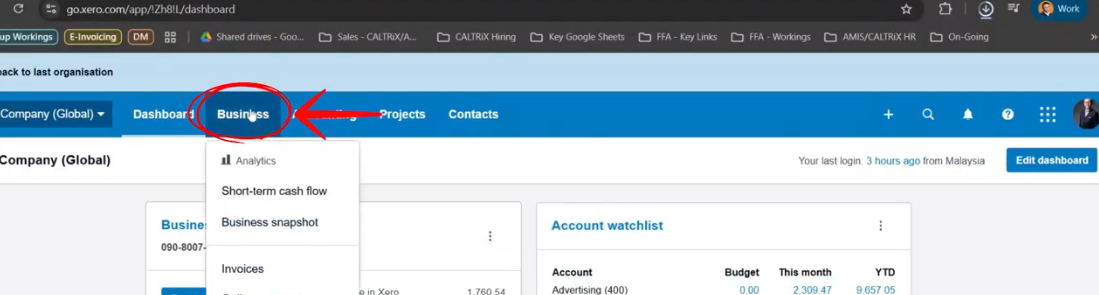

- Navigate to: Business > Invoices > New Repeating Invoice

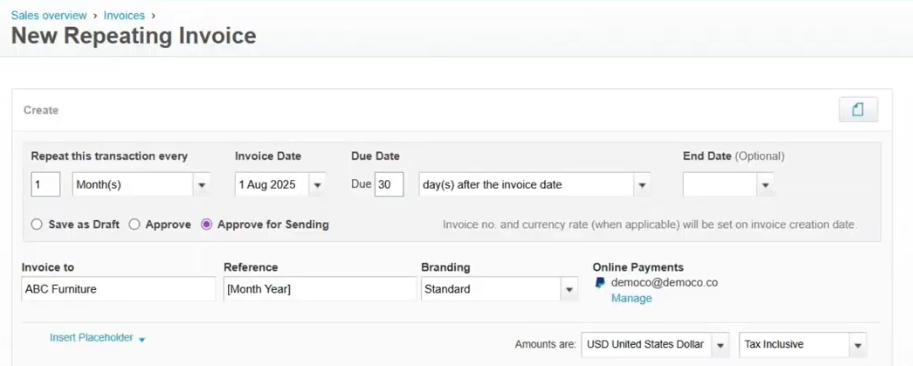

- Set Frequency: “Every 1 month” to match your billing cycle

- Set Next Invoice Date and Due Date (e.g., 30 days after invoice date depending on credit terms)

- Optional: Add an End Date to avoid perpetual billing

- Choose invoice status:

- Save as draft: Automatically created in Draft Tab for review

- Approve: Automatically approved and moved to Awaiting Payment Tab

- Approve and Send: Automatically approved and emailed to the client

- Select currency if invoicing in foreign currency, useful for international clients

- Fill in To (client), reference, and description

- Use variables like [Month Year] in the description so invoices auto-update each month

💡 Pro Tip: Enable auto-emailing to reduce admin follow-ups. You can also set reminders for unpaid invoices, making collection more efficient and professional. This feature ensures your team stays aligned on project tasks and deadlines, reducing the risk of delayed payments.

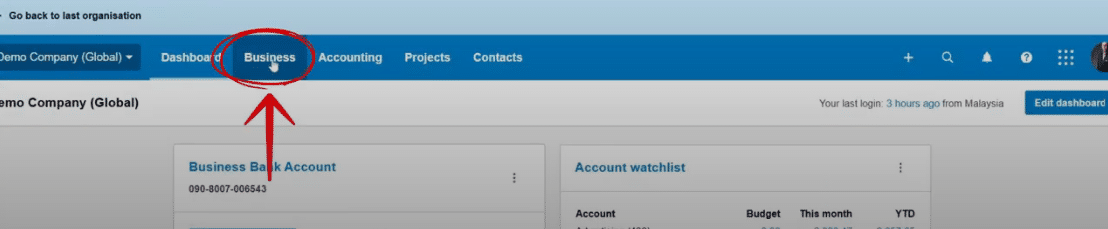

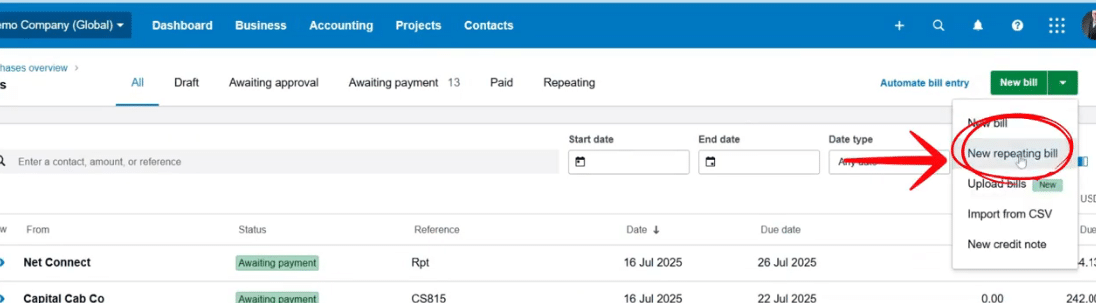

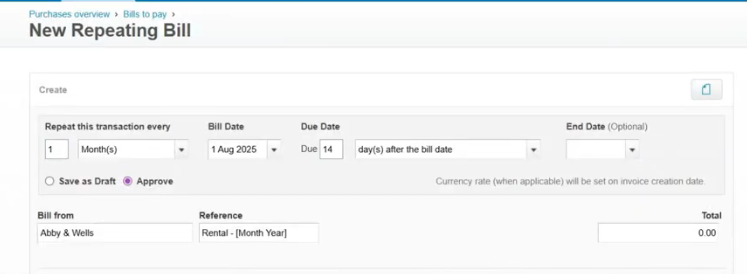

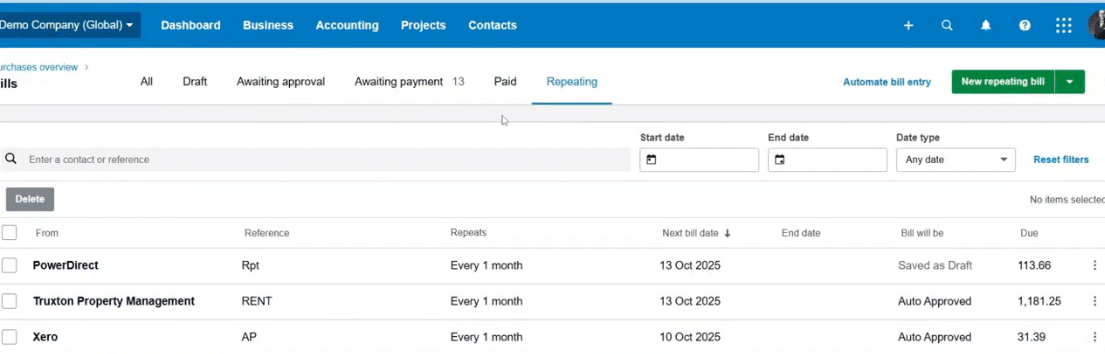

Repeating Bills to Pay Setup

Automating bills helps manage recurring expenses efficiently. Common recurring bills include office rental, utility bills, subscription services, and maintenance costs.

Example: Your company pays monthly office rent of RM2,800 on the 1st of every month. Tracking this manually can be error-prone, especially if you have multiple bills to manage. Automating this process ensures accuracy, timely payment, and keeps your cash flow predictable.

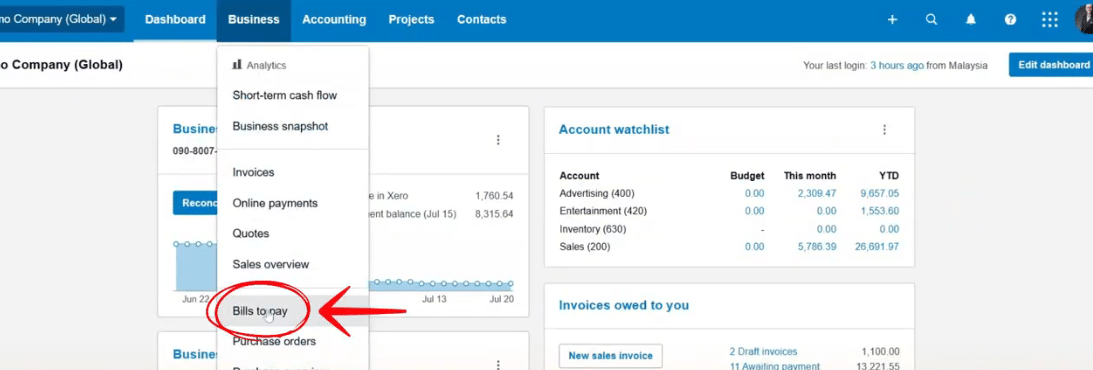

Steps to Set Up:

- Navigate to: Business > Bills to Pay > New Repeating Bill

- Set Frequency: “Every 1 month” to match your payment schedule

- Set Next Invoice Date and Due Date

- Optional: Add End Date if the bill is temporary or seasonal

- Choose status:

- Save as draft: Allows review if amounts vary month-to-month

- Approve: Automatically moves to Awaiting Payment Tab

- Enter From (vendor), reference, and description

- Use variables like [Month Year] in the description so bills auto-update based on schedule

- Fill in amount (exclude SST tax rate in Malaysia)

🛡️ Best Practice: Keep vendor bills in draft first, especially if amounts can vary. This allows review, prevents errors, and helps in the schedule management of outgoing payments. It also helps in tracking vendor transactions accurately for monthly reporting, cash flow monitoring, and audit compliance.

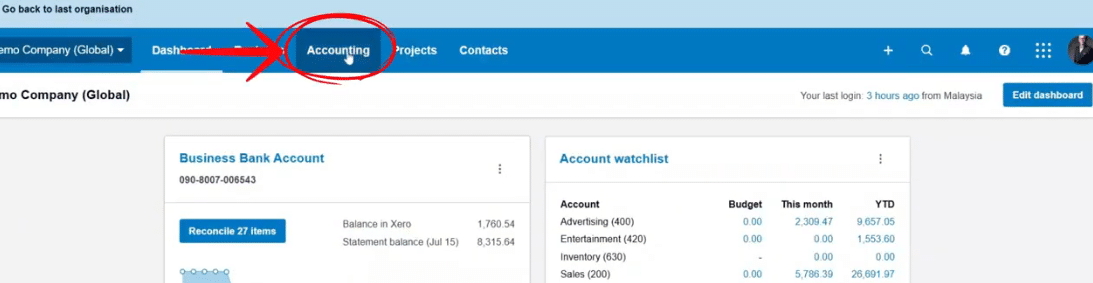

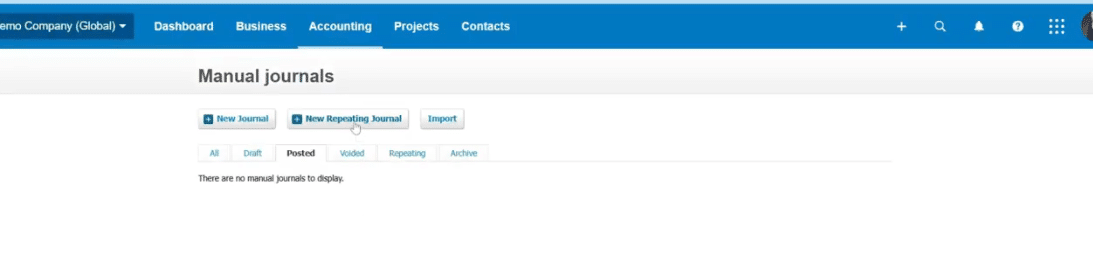

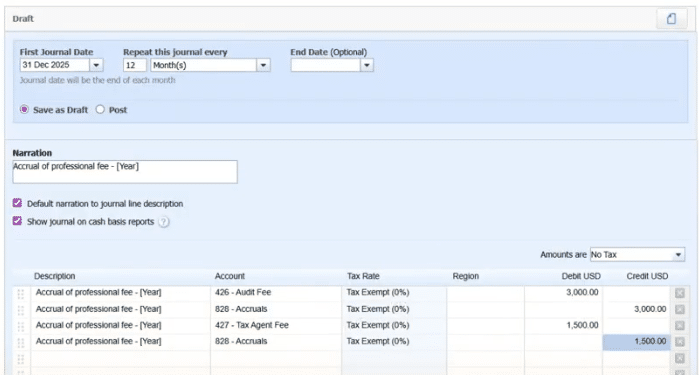

Repeating Journals Setup

Repeating Journals are ideal for recurring accounting entries that do not involve direct invoicing, such as salary accruals, depreciation, or annual professional fees.

Example: Yearly accrual of audit fees or tax agent fees. Without automation, these entries may be forgotten or entered inconsistently, causing discrepancies in financial statements.

Steps to Set Up:

- Navigate to: Accounting > Advanced > Manual Journals > New Repeating Journal

- Set schedule, debit/credit accounts, and description

- Use variables like [Year] in descriptions for clarity

- Choose Save as draft or Approve

- Click Save to finalize

⚠️ Note: Always check with your accountant before automating journals. Once approved, journals affect your books directly, so accuracy and compliance are crucial. Automating these entries ensures your project schedule for accounting is on track and reduces manual oversight.

💡If you’d like to learn how to add, edit, or delete a chart of accounts, check out our step-by-step guide here.

You can also check our step-by-step video guide on setting up recurring transactions in Xero here.

Approval Process & Approval Workflow in Xero: Ensuring Accuracy, Control, and Team Alignment

A proper approval workflow is critical for managing recurring transactions effectively. It ensures that every recurring transaction is verified before posting, reducing errors, improving accountability, and minimizing risk in financial management. For Malaysian SMEs, a structured approval process helps maintain control over transaction types, project tasks, and schedule management, while keeping the whole team aligned.

Key steps to optimize your approval workflow include:

- Create Templates for Recurring Entries – Standardizing templates for invoices, bills, and journals ensures consistency across all transactions. Templates allow you to define key components such as descriptions, accounts, amounts, and frequencies, making it easier to track actual progress and fast-track approvals.

- Track Approval Requests and Approval Flow – Use Xero’s built-in features to monitor approval requests and the approval flow. This gives visibility over which transactions are pending, approved, or require changes, helping teams stay on the same page and avoid bottlenecks.

- Maintain Audit History with Notes for Every Transaction – Keeping detailed notes and a clear audit trail ensures accountability and enables efficient reporting. This is particularly important when multiple stakeholders are involved, allowing everyone to review completion, progress, and resource assignments.

- Use Draft Mode for Bills with Variable Amounts – For bills where amounts may fluctuate month-to-month, saving them in draft mode allows for careful review before approval. This step supports schedule management and ensures that project plans are not disrupted by inaccurate entries.

- Regularly Review Actual Progress and Scheduled Postings – Periodic review of your recurring transaction schedule helps track project tasks, critical path, and timelines, ensuring all entries are aligned with your master schedule and overall financial plan.

Implementing a clear approval workflow not only reduces errors and miscommunication but also strengthens project management. By tracking task dependencies, managing resources, and controlling the approval process, your organization can maintain accurate, professional, and efficient recurring financial operations. This structured approach ensures your team works cohesively, all project tasks are completed on time, and every transaction is properly approved and auditable.

Common Mistakes to Avoid

Even with the powerful recurring transactions setup, mistakes can happen if recurring entries aren’t managed carefully. Here are some common pitfalls to watch out for:

- Forgetting End Dates → Without an end date, recurring transactions can continue posting indefinitely. This can lead to inflated expenses or income automatically, affecting your project schedule, cash flow, and overall financial reporting. Always define an end date when applicable to keep your schedule management under control and avoid unnecessary manual corrections later.

- Approving Automatically Without Review → Setting invoices, bills, or journals to approve automatically might seem convenient, but it’s risky if amounts or descriptions change from month to month. Skipping the approval workflow or approval process can result in errors that impact your actual progress tracking, reporting, and decision-making. Ensure your approval flow is properly set up so that each recurring transaction is checked before posting.

- No Variable Fields in Descriptions → Not using dynamic fields such as [Month], [Year], or [Month Year] makes invoices, bills, or journals look outdated and unclear. This can confuse clients, vendors, and even your own whole team when reviewing transaction types or reconciling accounts. Incorporating variables ensures that your financial records remain accurate, professional, and easy to track.

Awareness of these mistakes is crucial for maintaining accurate, auditable, and professional recurring transactions. By avoiding these pitfalls, your business can streamline project management, improve schedule management, and make sure that all key components of your financial operations are properly controlled and reported.

Best Practices for Xero Recurring Transactions

Implementing Xero recurring transactions effectively requires more than just creating repeating invoices, bills, or journals. Following best practices ensures your financial operations are accurate, auditable, and efficient while saving time and reducing errors. Here are some key strategies:

- Use Templates: Standardizing transaction types through templates helps reduce manual setup each time. Templates ensure that your key components—such as descriptions, accounts, amounts, and frequencies—are consistent across all recurring transactions. This not only improves project management by keeping all project tasks aligned and your team on the same page, but also enables fast tracking of recurring transactions, allowing your business to process entries more efficiently and save valuable time.

- Review Schedules Regularly: Set aside time to review your recurring transaction schedules. For instance, review repeating invoices monthly, bills to pay quarterly, and manual journals yearly. Regular review helps keep track of actual progress, determine errors early, and maintain control over your project schedule and schedule management. Staying on top of schedules also prevents surprises in your cash flow and helps assign resources efficiently.

- Add Placeholders: Use dynamic variables like [Month], [Year], or [Month Year] in transaction descriptions. This keeps invoices, bills, and journals up-to-date automatically, ensuring approval requests and approval workflow processes remain accurate. Variables help the team quickly identify transactions for specific periods, making reporting and auditing easier.

- Set Up Approval Workflow: Establish a clear approval process for recurring transactions. Track all approvals with notes and history to maintain transparency and accountability. A proper approval process prevents mistakes from slipping through and ensures all recurring entries are approved before posting. This step is crucial for project management, schedule management, and maintaining control over costs and timelines.

- Maintain Reporting and Auditing: Keep comprehensive records for all recurring transactions to ensure compliance, transparency, and accurate reporting for stakeholders. Maintaining an audit trail allows you to track progress, determine risks, and verify that all transactions align with your project plan and overall business objectives.

Following these best practices helps your business save time, reduce errors, and streamline financial operations. It ensures your project plan, critical path, and schedule management for recurring financial transactions remain accurate, efficient, and easy to monitor. Proper implementation also allows your organization to manage resources, tasks, and communication more effectively while keeping the team informed and aligned.

Final Thoughts on Recurring Transactions Setup

Stop spending countless hours on repetitive administrative tasks — let recurring transactions handle the heavy lifting for your business. When implemented correctly, it not only improves accuracy and reduces manual errors, but also minimizes the administrative burden on your finance team. This allows your team to focus on more strategic project tasks, efficient schedule management, and initiatives that drive overall business growth.

Automating your recurring invoices, bills, and journals also ensures that all transaction types are processed consistently, tracked effectively, and remain auditable for compliance and reporting purposes. With proper approval workflows and templates, your organization can maintain control over resources, tasks, and timelines while keeping the team aligned.

📞 Looking to streamline more processes in Xero or reduce month-end stress? Reach out to CALTRiX — we help Xero users across Malaysia and worldwide fully leverage the Xero ecosystem to maximize efficiency and accuracy. Contact us at connect@caltrix.asia or schedule a call with our experts today!

By adopting these practices, your business will save valuable time, reduce errors, and achieve a more organized and professional approach to financial management, giving you peace of mind and better control over your operations.

About Xero

Xero is a global small business platform with 4.4 million subscribers. Xero’s smart tools help small businesses and their advisors to control core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and control their finances more efficiently.