The introduction of the national e-invoicing initiative mandated in Malaysia marks a significant shift in how businesses handle invoicing and tax reporting, especially small businesses.

From 1st August 2024, the Inland Revenue Board (LHDN) of Malaysia uses Peppol framework, will require businesses implement e-invoicing and to submit e-Invoices in Malaysia with a validated e-invoice. This initiative aims to streamline transparency and compliance, reduce paperwork, and enhance tax collection efficiency.

Using a solution of cloud accounting software, Xero cloud accounting system (Xero is one of the approved Peppol Service Providers by MDeC) plays a crucial role in helping Malaysian businesses comply with the e-invoicing mandate. Xero and Tickstar (Xero’s subsidiary) as an E-Invoice Cloud Accounting Software, has built the direct integration to LHDN’s Application Programming Interface (API) for instant validation to ensure compliance of e-invoicing. Rest assured, Xero system has robust security features to protect your confidential financial information.

This step by step guide walks you through the 10 vital steps to submit your consolidated eInvoices in Xero Accounting Software.

1. Ensure MyInvois Portal Setup is Correct

This is the first step to implement e-Invoicing. Before diving into the Xero setup, register for e-invoicing to ensure that your MyInvois portal is correctly configured. A small misconfiguration in the settings could lead to validation failures, resulting in unnecessary delays when submitting your eInvoices.

It’s crucial to follow the correct steps to register as a taxpayer and designate an intermediary for your eInvoice compliance.

Tip: Double-check that your portal settings are correct to avoid any hiccups in the submission process. A small misstep can lead to rejected submissions and delays. Our recommended date is in mid of June 2025.

Action Items:

- Register for e-invoicing with Xero on the MyInvois Portal.

- Add your intermediary for e-invoicing purposes.

2. Complete Set Up in Xero & Connect to Invoici

Once your portal is ready, make sure your Xero account is connected to Invoici (All Xero users are accessible to Invoici) for integration with the LHDN API system. This integration allows you to submit eInvoices directly from Xero. Follow the instructions provided by Xero on how to register and connect to Invoici: Xero eInvoice Integration Guide.

Action Items:

- Log in to Xero, go to Xero Settings and verify business information.

- Connect Xero to Invoici for seamless integration with LHDN. You may import your business QR Code generated from MyInvois Portal to update your profile.

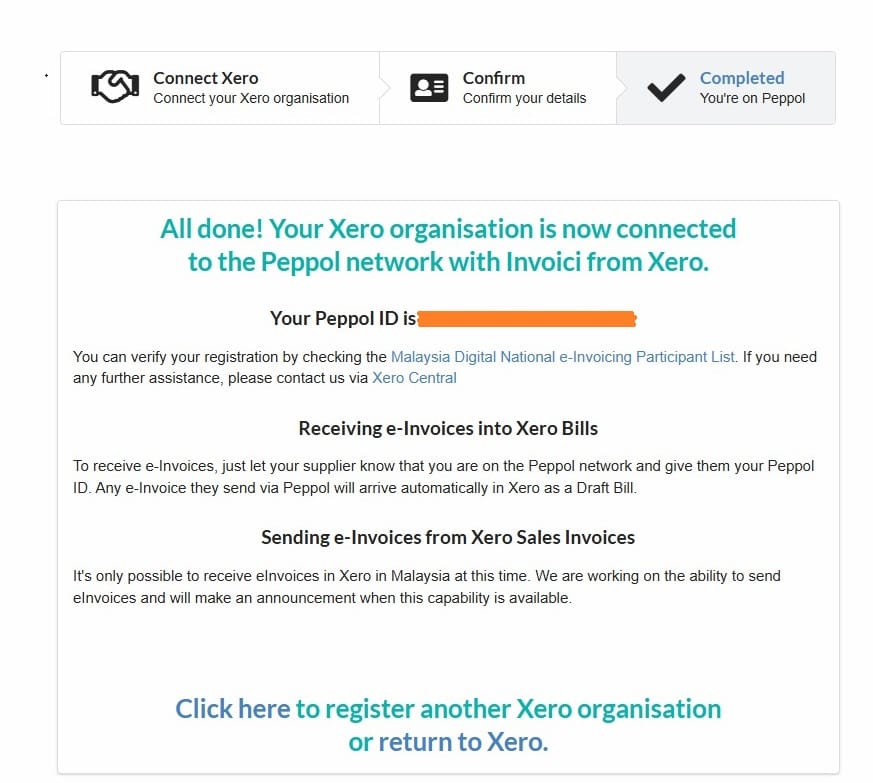

- Upon connection is successful, you will see the screenshot below that indicates your unique Peppol ID

3. New Contacts and New Tracking Category in Xero

New Contacts

- Upon completion of step 2, Xero organisation will create 2 contacts for you including the dedicated email address for your submission in the later stage.

- Important Emails:

- Consolidated eInvoice: consolidated@invoi.ci

- Consolidated Self-Billed eInvoice: consolidated-selfbilled@invoi.ci

New Tracking Category for MyInvois Classification

A key component of Xero’s integration with LHDN is the Tracking Category. This tracking category must be linked to the correct Classification codes to ensure that your eInvoices are processed and categorized properly by the Inland Revenue Board of Malaysia (LHDN).

Tip for Xero Users: The tracking category is auto-created once connected to Invoici. Just ensure that the tracking category is ready and has one available slot before establishing the connection.

Please note that the MyInvois Classification codes are based on the official MyInvois Classification Codes, which categorize different types of business nature.

It’s essential to match your sales or expense activities and transactions to the relevant classification code to comply with e-invoicing requirements.

Action Items:

- Ensure your Xero account has one available slot for a tracking category.

- Verify that the Tracking Category is created for MyInvois classification.

- Refer to the official MyInvois Classification Codes to correctly categorize your accounting entries.

4. Update Contacts with Required Data

Ensure that your contacts (customers and suppliers) are updated with all necessary details required for e-invoicing. Without this critical data, your eInvoices cannot be processed properly. The information should include accurate business name, Tax Identification Number (TIN), addresses, other contact details and other relevant data.

Action Items:

- Review and update customer and supplier information in Xero.

- Confirm that all fields, such as tax numbers, are correctly filled.

5. E-Invoice for Sales

During 6 months interim relaxation period, you may send normal invoices and receipts to your clients as the legal supporting document. If your client request for a validated e-invoice, you may reject the request during the 6 months period.

For sales invoices, using Xero invoicing system to ensure that each line item contains the required details such as the unit price, amount, and tax rate during your data entry. Xero allows you to tag sales invoices with the relevant tracking category to ensure they are properly classified when submitting the eInvoice.

Tip for Xero Users: Tagging each sales invoice transaction with the tracking category ensures that the MyInvois classification is correct and that the submission to LHDN is smooth.

Action Items:

- Tag every sales invoice with the appropriate Tracking Category before the 3rd of following month. Receipts are not required to submit for e-invoice.

- Ensure all relevant data (price, amount, and tax rate) is included.

6. E-Invoice for Bills to Pay (Self-Billed)

In certain circumstance under Section 8.3 of the e-Invoice Specific Guideline by LHDN, buyer (Taxpayer) need to bill himself on behalf of supplier. These specific needs of self-billed can be utilized in Xero’s Bills To Pay feature.

For example, if your business imports goods from a foreign supplier, you (Buyer/Taxpayer), having made the payments must submit a self-billed e-invoice to LHDN.

Another example is when you are dealing with an individual who is not conducting a business; you (Buyer/Taxpayer), having made the payments, must issue a self-billed e-invoice to LHDN.

Therefore, as the buyer, all Xero users need to ensure that the Tracking Category is applied to all line items in transactions. This step ensures that you generate a self-billed eInvoice.

Action Items:

- Apply the Tracking Category to all line items in the bills to pay transactions as one of the tracking categories as below

- 033 – Self-billed – Betting and gaming

- 034 – Self-billed – Importation of goods

- 035 – Self-billed – Importation of services

- 036 – Self-billed – Others

- 037 – Self-billed – Monetary payment to agents, dealers or distributors

- Double-check for all your bills to pay transactions that fall under the categories as above to ensure proper self-billed e-invoicing.

7. Consolidated E-Invoice and Self-Billed E-Invoice Creation

On the 4th of the following month (after 30 days), your consolidated eInvoice and self-billed eInvoice will be automatically generated in Xero. These automations facilitate Xero users to review the generated invoices to ensure they reflect all the correct information before sending to MyInvois Portal through API.

Tip for Xero Users: The system may experience heavy traffic and delays after lunch hours. If you’re submitting on the last day, try to send your eInvoice for validation before 8 AM to avoid delays.

Action Items:

- Confirm that the consolidated eInvoice and consolidated self-billed eInvoice is generated (Screenshot as below).

- Review every line item in both consolidated eInvoice and consolidated self-billed eInvoice for all relevant categories as per point 6 above.

8. Checklist for Consolidated E-Invoices and Consolidated Self-Billed E-Invoices

Before submitting, ensure all details in the generated consolidated eInvoices and consolidated self-billed eInvoices are correct. Here’s your action item checklist:

Consolidated eInvoices (for sales related)

- Verify if all sales invoices transactions, debit note and credit note details that are tagged with the tracking category are listed in the consolidated eInvoices.

- Ensure the tax rate is correct (SST 8%, 6%, or Tax Exempt 0%).

- Double-check the total amounts for sales and tax is correct.

- Please note that entries in manual journals will NOT appear in consolidated eInvoices.

- Please DO NOT approve this sales invoice.

Consolidated Self-billed eInvoices (for bills to pay related)

- Verify if all suppliers bills and credit notes that are tagged with the self-billed tracking category are listed in the consolidated self-billed eInvoices.

- Consolidated Self-billed eInvoices should show either 0% Tax Rate or Tax Exempt (0%). Please do not put any of the tax rate of SST 8% or 6%.

- Double-check the total amounts.

- Please note that entries in manual journals will NOT appear in consolidated self-billed eInvoices.

- Please DO NOT approve this bill.

9. Submit by the 7th of the Following Month for validated e-invoice

The eInvoice submission deadline is the 7th of the following month ends. Once everything is confirmed, submit your consolidated eInvoice and consolidated self-billed eInvoice to MyInvois Portal through API to validate your e-invoices.

Tip for Xero Users: Timing is critical. If you’re submitting on the last day, it’s recommended to submit before 8 AM. Submitting in earlier date helps avoid delays caused by API system congestion later in the day.

Action Items:

- Submit by 7th of the following month via sending it as an email to validate the eInvoices, it’s exactly the same as how you normally send an invoice to your customers from Xero. (The dedicated email address already created by Xero automatically – Refer to Point 3 above.)

- Check the History & Notes section for any changes or updates. You as the user will be notified for the status of your submission status for both consolidated eInvoice and consolidated self-billed eInvoice to Lembaga Hasil Dalam Negeri (LHDN). Any errors in your e-invoice submission will be showing there, allowing you to solve the issues with an efficient manner.

- After the validation is completed, you will find a PDF supporting document under Contact -> Consolidated E-Invoice -> Files.

- A MyInvois Validation URL will be generated as screenshot as below which you can access using it to ensure your submission has completed.

10. Prepare for Next Phased e-Invoicing Implementation

Phase 2 – Post-Relaxation Period (1st July 2025 onwards)

After 6 months of relaxation period for Phase 2 businesses, you will be required to submit individual e-invoices and consolidated eInvoices from 1st July 2025. Rest assured that Xero is already equipped with this feature.

Please beware that there are different submission methods for B2B, B2C and B2G of your business activities. Business grows over time and changes your implementation.

Phase 3 – Starting 1st July 2025

For businesses transition to Phase 3 (Turnover between RM 5 million to RM 25 million) of the e-invoicing in Malaysia mandate starting from 1st July 2025.

Phase 4 – Starting 1st January 2026

For businesses transition to Phase 4 (Turnover between RM 1 million to RM 5 million) of the e-invoicing in Malaysia mandate starting from 1st January 2026.

Phase 5 – Starting 1st July 2026

For businesses transition to Phase 5 (Turnover between RM 500,000 to RM 1 million) of the e-invoicing in Malaysia mandate starting from 1st July 2026.

Please note that Turnover below RM 500,000 is not applicable to comply to e-invoicing at all. Regardless of which phase, there are additional steps you may start to take:

- Start collecting required data for both the supplier and buyer: Required data needs to be updated in the Xero system. In the future, Xero organisation might launch a feature to extract key data through a QR Code, stay tuned!

- Conduct Due Diligence on Business – Different transactions and activities may require different accounting treatments based on well-governed standards of the Malaysian Tax Authority. Ensure your data is structured correctly and understand the benefits of e-invoicing.

- Review & Update Your SOPs – E-invoicing will change your workflows, requiring add-on adjustments for greater accuracy.

- Equip Your Team with the Right Knowledge – Understanding e-invoicing is essential to avoid errors and inefficiencies.

- Consider Engaging an E-Invoicing Consultant – If you’re unsure, seeking expert guidance can save time and reduce compliance risks.

Action Items:

- Monitor for any new updates regarding e-invoicing post-relaxation.

As a summary, submitting eInvoices through Xero helps businesses maintain tax compliance and streamline their invoicing processes. With the 10 vital steps outlined above, businesses in Malaysia can ensure they meet the LHDN e-invoicing mandate and keep their operations running smoothly leveraging on Xero Cloud Accounting Software as the e-invoicing tool. Stay updated with the latest changes and continue to use Xero for all your e-invoicing needs.

💡 Looking for e-invoicing providers for implementation support? Let’s connect if you still have questions about this blog! I’d be happy to share insights and help streamline the process for your business towards real-time financial data with accurate financial reports on a monthly basis.

CALTRiX one of the largest Xero partners in Malaysia and awarded the winner of Xero Partner of the Year in 2024. Our professional implementation service for e-invoice includes 360 degree analysis of your business, Xero support, consultation and more to ensure you stay informed with latest E-Invoicing update in Xero and LDHN via notifications.

Frequently Asked Question (FAQ)

1. How does Xero’s eInvoice feature help in eInvoice submission?

Xero simplifies the e-invoicing process by automating the submission of both consolidated and self-billed eInvoices to LHDN. With Xero’s integration, businesses can ensure compliance with the LHDN e-invoicing mandate with minimal manual effort.

2. What is Xero e-invoicing?

Xero e-invoicing is a cloud-based solution that automates the generation, submission, and tracking of invoices in compliance with Malaysia’s e-invoicing requirements. Xero integrates seamlessly with the LHDN, ensuring that all required data is submitted correctly to the tax authorities.

3. How does LHDN receive the eInvoices from Xero?

LHDN receives eInvoices through the MyInvois Portal or API connection. Xero automatically submits the necessary eInvoice data to LHDN on your behalf, ensuring compliance.

4. What is a consolidated eInvoice?

Consolidated eInvoices summarize multiple transactions into one document. These are typically used when a buyer does not request individual invoices. They are submitted to MyInvois on a monthly basis, as per the LHDN mandate.

5. What is a self-billed eInvoice?

A self-billed eInvoice is used to document expense transactions, particularly in cases involving foreign suppliers or specific scenarios outlined by LHDN. This invoice allows businesses to bill themselves for transactions rather than relying on the supplier to issue an invoice.

About Xero

Xero is a global small business platform with 4.2 million subscribers. Xero’s smart tools help small businesses and their advisors to control core accounting functions like tax and bank reconciliation, and complete other important small business tasks like payroll and payments. Xero’s extensive ecosystem of connected apps and connections to banks and other financial institutions provide a range of solutions from within Xero’s open platform to help small businesses run their business and control their finances more efficiently.